Former President Donald Trump visits the Alpha Gamma Rho, agricultural fraternity, at Iowa State University before an NCAA college football game between Iowa State and Iowa, Saturday, Sept. 9, 2023, in Ames, Iowa. (AP Photo/Charlie Neibergall)

Sixty-five percent of Americans believe corporate taxes should be raised and roughly six in 10 Americans said it bothered them a lot that corporations and some wealthy people “don’t pay their fair share,” according to a Pew survey. Donald Trump has other ideas.

If Donald Trump returns to the White House in 2025—as polls suggest he has roughly a 50/50 chance of doing—slashing the tax rate for big corporations could be one of his top priorities, according to new reporting from the Washington Post.

Trump and his economic advisers have discussed cutting the corporate tax rate to as low as 15%, if he’s elected, according to the Post’s interviews with several of those advisers.

Trump, who currently holds a sizable lead in the 2024 Republican presidential primary, previously lowered the corporate tax rate from 35% to 21% as part of his unpopular 2017 tax law that mostly benefited billionaires and big businesses.

The proposal, which is at odds with the populist rhetoric Trump has displayed on the campaign trail, would cause the nation’s deficit to skyrocket, just as his 2017 tax law did.

Trump’s advisors have reportedly debated paying for the tax cut by implementing a 10% tariff on all imports to the United States, a move that would cause consumer costs to surge.

In a statement provided to the Post, Trump campaign spokesperson Jason Miller said that Trump has “not yet committed to specific tax cut numbers for his second term agenda,” but was contemplating “many ideas.”

Steve Wamhoff, federal policy director at the Institute on Taxation and Economic Policy, told the Post that doubling down on corporate tax cuts would be an “astonishing” decision by Trump, given the broad desire among Americans to raise taxes on corporations to make them pay their fair share.

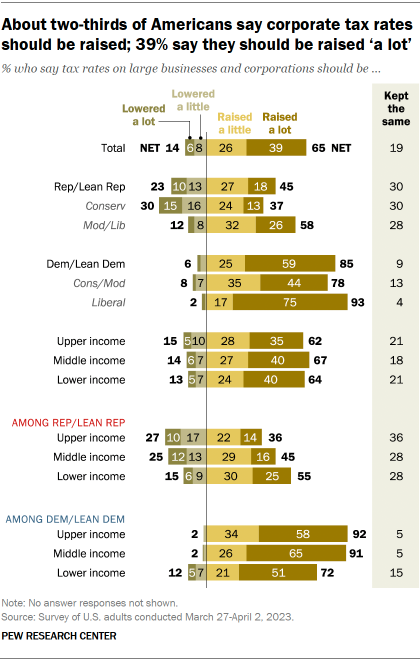

Nearly two-thirds of Americans (65%) believe corporate taxes should be raised, while only 14% believe they should be lowered, according to a recent survey from the Pew Research Center.

Roughly six in 10 Americans said it bothered them a lot that corporations and some wealthy people “don’t pay their fair share,” according to the Pew survey.

The Biden campaign on Monday was quick to criticize the proposal and contrast it to the president’s accomplishments.

“This is the story of the Trump economy — blowing up the deficit to help out his wealthy friends at the expense of hardworking Americans and their families,” campaign spokesperson Ammar Moussa said in a statement. “Bidenomics is undoing the damage Trump wrought by growing the economy from the bottom up and middle out, creating millions of middle-class jobs, lowering costs for families and all the while ensuring the ultra-wealthy pay their fair share.”

Biden last year signed the Inflation Reduction Act, a law that established a 15% minimum tax on corporations that previously exploited the tax system and claimed deductions and other tax credits, ultimately paying nothing in federal income taxes. The law also implemented a 1% tax on stock buybacks, which is what happens when companies purchase shares of their own stocks—moves that often enrich already-wealthy shareholders by driving up the value of the stock.

Biden has also pushed for a 15% global minimum tax rate for corporations to prevent countries from competing against each other by lowering tax rates below that level.

Politics

DeSantis ‘will not comply’ with rules to protect transgender students

"Refusing to comply with Title IX could have damaging consequences for schools, including significant loss in funding on the order of hundreds of...

Housing market cools along Florida’s Gulf Coast

The uptick in the construction of new housing followed the influx of newcomers to Florida during the pandemic, but that boom is now tapering off....

Local News

DeSantis ‘will not comply’ with rules to protect transgender students

"Refusing to comply with Title IX could have damaging consequences for schools, including significant loss in funding on the order of hundreds of...

Housing market cools along Florida’s Gulf Coast

The uptick in the construction of new housing followed the influx of newcomers to Florida during the pandemic, but that boom is now tapering off....